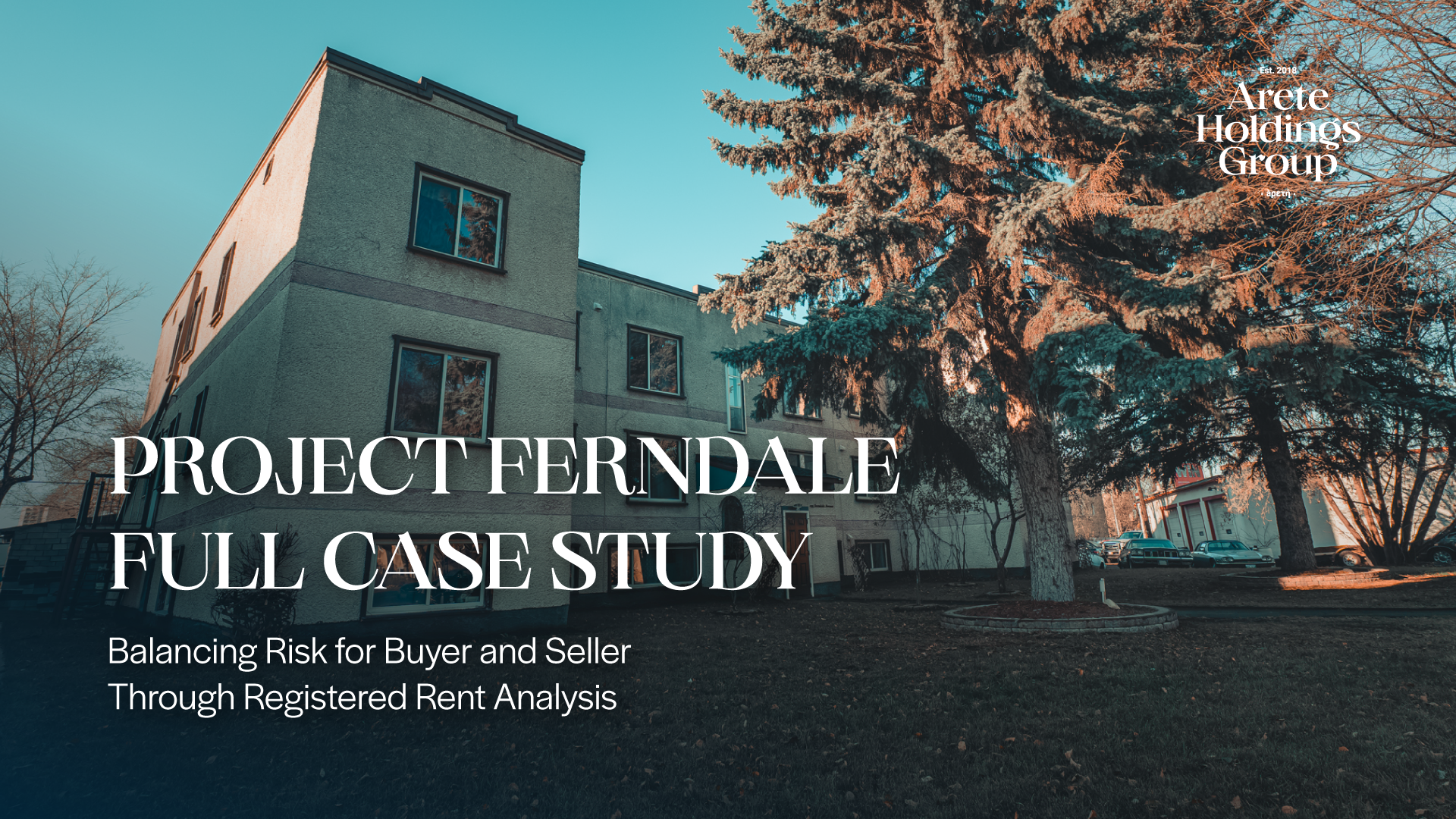

PROJECT FERNDALE — FULL CASE STUDY

INTRODUCTION

Project Ferndale was a transaction where both the purchaser and the seller recognized that they needed impartial, technical guidance. The building was listed for sale and placed under a conditional offer by one of our existing clients. On the surface, the numbers looked reasonable. But once due diligence began, it became clear that the current rents were not aligned with the registered rents on file.

Rather than taking adversarial positions, both parties engaged Arete to help them understand the implications, correct the information, and determine whether — and how — the sale could proceed in a fair and transparent way.

PROBLEM

After going conditional on the purchase, the prospective buyer discovered that the in-place rents were non-compliant. The registered rents were materially lower than what tenants were paying. This raised immediate concerns. For the purchaser, there was a risk of future rent rollbacks and a building that would not perform as expected. For the seller, there was exposure around misrepresentation, even if unintentional, and uncertainty around whether the work done over the years justified the current rent levels.

Both sides needed clarity. Neither wanted to proceed based on inaccurate assumptions.

DISCOVERY

We began by reviewing the building’s rent history, registered rent records, and the past work the seller had completed. We needed to determine whether the building’s condition and improvements could support higher registered rents and, if so, how that could be documented and presented.

At the same time, we assessed the building’s overall viability for the purchaser: value relative to income, the scope of any required construction, and whether future registered rents could reasonably reach market levels through lawful increases.

Strategy

We structured our involvement in a way that allowed us to act collaboratively. First, we evaluated for the seller whether his past renovations and upgrades could be used to increase the registered rents to align with what was being charged. Second, we developed a clear framework for the purchaser, outlining what the building would look like under corrected rent levels, what construction might be necessary, and how that would affect both current performance and long-term value.

The goal was not to force the sale forward or to kill the deal, but to give both parties the information they needed to make a sound decision.

EXECUTION

We performed a full rent-control analysis, identifying where registered rent could be legitimately increased based on prior work and where it could not. We communicated our findings to both parties, explained the implications, and helped them understand the range of possible outcomes.

For the seller, we clarified what steps would be required to correct the rent roll and register lawful increases. For the purchaser, we provided a realistic picture of future performance: what rents could be achieved through properly documented improvements, what construction would be necessary, and how the building would likely appraise and cash flow under those conditions.

RESULTS

The result was a transaction process grounded in facts rather than assumptions. The purchaser was able to make an informed decision based on a clear understanding of both risk and opportunity. The seller was able to address compliance issues and approach the sale with transparency.

By working with both sides, we minimized risk for the purchaser, reduced exposure for the seller, and created the conditions for an optimal transaction — whether they chose to proceed or not.

Project Headingley shows why Arete Holdings Group is trusted with the most complex, high-risk, multi-layered situations in the province.

Where municipalities, police, and owners could not act, we delivered clarity, control, and a complete resolution.

This wasn’t just an eviction.

It was the restoration of a multi-million-dollar asset.

That’s the Arete standard.